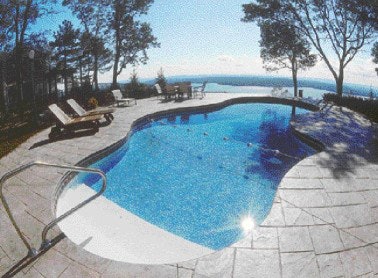

Flip through the pages of trade magazines or walk down the aisles of industry trade shows and you're sure to see plenty of new patterns being introduced by vinyl liner manufacturers and fabricators. Some years it's new shades of old standby colors like blues and greens. Other years earth tones and non-traditional pastels are trotted out. Recently, glass-tile and mosaic patterns have been popular. Industry leaders spend a good deal of time and money developing these patterns in an attempt to distinguish themselves from their competitors and increase their chances of catching customers' eyes. Some changes, however, aren't visible to the eye. While there may not appear to be any difference from one year to the next other than new combinations of colors and shapes, there's been a lot of innovation going on with the vinyl itself.

AQUA spoke with manufacturers and fabricators about these changes, and about cooperation among fierce competitors to improve the product across the board.

Chemical Considerations

Among the newest innovations in the vinyl-liner industry is Haloshield, introduced last fall at the International Pool & Spa Expo in Las Vegas by PolyOne Engineered Films. Haloshield is essentially an additive that's put into the topcoat of printed pool liner sheeting, according to Bob Hayes, a salesperson for the Winchester, Va., manufacturer.

"The additive attracts the free chlorine molecules to the surface of the liner, where the free chlorine can kill the many biological organisms that can grow on the surface of the top-coated vinyl liner," he explains. "The fancy way of saying it is the Haloshield additive creates a 'chemical hook' property where it attracts the free chlorine to the treated surface."

Another benefit, according to Hayes, is that as the pool water ages and the free chlorine is used up by the Haloshield-treated surface, the surface can be recharged simply by adding fresh chlorine to the water.

"The Haloshield-treated surface will perform, as long as the topcoat has not been abraded or compromised, for the life of the treated surface," he says.

Several fabricators have agreed to try Haloshield in their liners this year, including Pen Fabricators in Emigsville, Pa., and Robert Hotaling, president of Pen Fab, says he's excited about it.

"A lot of work has gone into making the vinyl UV-resistant, and there are biocides in the vinyl, too," he says.

"But Haloshield is the biggest thing that's come up in quite a few years."

For the additive to be effective, Hotaling and Hayes caution, pool owners need to keep a chlorine residual in the pool. In other words, Haloshield is not a panacea that will eliminate chemical maintenance. That's something everyone who sells it is going to have to keep in mind. Failure to do so will hurt the industry by disappointing oversold customers.

"My fear is if we don't have enough literature and a good story to tell, the dealers will tell their customers they won't have to take care of their pools," Hotaling says. "But of course we know that isn't true. It will help them, but they're still going to have to do maintenance and use chlorine."

Hayes shares Hotaling's enthusiasm and concern. "We're trying to be careful so this new product's capabilities are not oversold or misunderstood. A concept like this can be misunderstood," he says. "It's neither a magic bullet nor a cure-all for all vinyl-liner pool issues.

"As we understand it there are three parts to a successful liner. No. 1) proper raw material ingredients and correct processing to make the vinyl for the liner by the vinyl sheeting manufacturer, No. 2) the liner has to be measured and cut properly by the fabricator to the correct dimensions so the liner is the correct size for the pool site where it will be installed, and No. 3) the homeowner/pool dealer/service company has to correctly chemically and physically maintain the pool. It's similar to a three-legged stool. If one leg of the three is compromised the other two cannot make up for the loss. If any of those legs is kicked out, you'll see problems such as shortened liner life."

Another of PolyOne's customers for Haloshield is Newmarket, N.H.based fabricator Vyn-All Products Corp. Company president J. Kevin Shea says he sees a segment of the market that will gravitate toward the new product, but like the others thinks everyone involved needs to market it carefully.

"I think it'll require some specialty marketing on the part of the fabricators who offer it — maybe in conjunction with the manufacturer," he explains. "PolyOne gave us promotional materials for the national trade show, and now it's up to us to figure out how to present it to the dealers. They will then have to figure out how to promote it to the homeowners. So I see it as a three-part process."

Haloshield is far from the only innovation to come out recently. Victory Plastics, Haverhill, Mass., recently introduced a product designed to catch sunlight hitting the liner. "The industry is still design-driven," says Mark Delaney, vice president of market development. "So we developed an innovative product that consists of glitter particles imbedded into the liner during the manufacturing process. This creates a sparkle effect when sunlight or pool lighting hits it."

Delaney adds that Victory is active in materials innovation, too, citing his company's X-Treme formulation, which he says aids in chemical resistance and helps prevent fading and bleaching due to direct UV radiation. "That's definitely a premium product," Delaney says, adding that Victory will also be offering a topcoat additive like Haloshield, which was developed by Vanson HaloSource.

"I'll call both the X-Treme and the Vanson additive upgrades," he says, estimating that a liner with Victory's "chemical hook" topcoat additive will cost about 20 percent more than a liner without it. He, too, cautions against overselling the benefits of the chemical hook. "I can't claim it will save maintenance . . ."

Common Bonds

Fierce competition among the industry's manufacturers and fabricators spawns many innovations, but sometimes these adversaries sit down to work on common problems and to make improvements to the product in the name of advancing the category as a whole.

Vyn-All's Shea is among the leaders in this area. He's the chairman of the Vinyl Fabricators Association, an industry group that's been meeting twice a year since 2000.

"The focus is to identify problems that, if left unattended, would hurt the vinyl segment," he says. "We've tackled abrasion problems related to automatic pool cleaners, copyright issues and codes of ethics aimed at protecting time and investment."

Working on the abrasion problem was the new association's first accomplishment, Shea says, and it came about because of cooperation from the vinyl industry and the makers of automatic pool cleaners, which changed wheels and brushes to lessen the impact on the printed liners.

The APC abrasion problem has always been around but is made more noticeable when the surface area of a printed liner is covered by a heavier coating of ink, says Ken Garrett, president of Garrett Liners in Fallsington, Pa.

"APC abrasion is only a problem on a small number of liners, it's not widespread," Garrett says. "I thought we'd resolved the problem, but I'm hearing of at least one brand still causing problems."

Still, Shea says, the problem is "almost non-existent" compared to several years ago.

Another material-related issue the industry is working on is what's known as "snap back."

Garrett explains: "When the vinyl is wound on a roll by automatic machinery, it's wound on tightly. But when it gets into our plant and it's taken off the roll for cutting, it shrinks lengthwise."

Fabricators factor in this shrinkage by making the pieces of vinyl slightly larger than they need to be. These calculations are made more difficult because when a liner gets out into the field, it should be slightly smaller than the size of the pool. "That's so the weight of the water will stretch it out and give it a very tight fit."

As yet, the association hasn't come up with a solution to this problem, but Shea remains optimistic, citing the success it had working on the APC issue.

"I can tell you it's started to lead us in a very positive direction. We're independent but we come to share common problems and work on solutions, and that's very healthy.

"If we can all attract another five percent to the category it stands to reason it'll be up to us to compete for it. But none of us would be competing for it if they were going with fiberglass or gunite."

From Resin To Residence A vinyl liner’s journey.

Ever wonder how vinyl liners come to be. Or what the difference between a manufacturer and a fabricator is.

The first thing to understand is that there are two players at the front end of the equation: the manufacturers and the fabricators. Manufacturers, which include Canadian General Tower, PolyOne and Victory Plastics, take the raw resin, heat it and send it through large steel rollers that spread it out according to the fabricator's width and gauge specifications. This process is called calendering.

From there the material is taken to an engraving house, which will apply a pattern in a rotogravure printing process.

"Each manufacturer will have an in-house line to offer to all fabricators," says Mark Delaney, vice president of market development for Victory Plastics. "We have six to 10 patterns that we'll sell to anybody. Those patterns are fairly generic, but they're popular."

In addition to these stock patterns, fabricators like to offer proprietary patterns, which they use to differentiate themselves from the 20 or so other fabricators competing for the attention of distributors and dealers.

"We go see the fabricators in October or November and we'll present them with design concepts based on current trends, which we get from the Color Institute and from outdoor living textures and patterns," Delaney says. "Once we've presented the customer with a portfolio, they'll select three to five and focus-group them. Ninety-nine percent of the time they'll want modifications."

"We have creative people here that know about visuals and colors and the casual furniture trends, so that helps us," says Robert Hotaling, president of Pen Fabricators. "If you've got creative people in-house, you don't have to rely only on the manufacturers."

Hotaling and other fabricators say it's important to offer a mix of proprietary and stock patterns. Proprietary ones attract customers but have to be ordered in large quantities and must be stored. Stock patterns, on the other hand, offer fabricators efficiency and savings, but not a way to separate themselves from the other fabricators.

"The key it to have a good blend. You can't sell only me-toos," says Hotaling. "There are several reasons customers come to a fabricator, and patterns are only one, but if you start to eliminate the patterns that make you unique, then service, quality and price would be the only difference. And if you all had the same patterns, price would be very close."

Once a fabricator has selected its patterns, it'll introduce them at industry shows or put them into their new catalogs.

"That's when they'll start placing orders from us for the actual vinyl," Delaney says.

The vinyl, after it's been calendered and printed, comes to the fabricators in roll form.

"The fabricator then cuts it to the pool size he requires, welds the panels together by one of two welding methods, then assembles the pool," Delaney says.

—B.K.