It's nearly impossible to pinpoint the exact moment when the world became "aware" of the fiberglass pool. Different sources provide their own historical interpretations, but they all lead to the same conclusion: the fiberglass pool industry has exploded and is well on its way to becoming a leader of change within the market.

Early introductions of fiberglass pools required a different sales tactic than what's used today. "In the early days, when I first started selling pools,we had to sell people on the fiberglass," says Curt Prystupa, president of Sun Fiberglass Products. "We had to tout the '17 times stronger than cement' and take a piece of fiberglass and beat it on the concrete driveway and let [the fiberglass] chip it."

Nowadays, fiberglass can almost sell itself thanks to the volumes of information available on the Internet,not to mention its exposure on home makeover shows. But it's the motivated consumer who does most of the leg work.

Consumer Driven

"Surprisingly, the consumer, the buying public, is pushing this product along," says Michelle Stewart, national sales director for Hawaiian Fiberglass Pools and Aloha Pools.

When Hawaiian and Aloha Pools participated in an episode of Extreme Makeover: Home Edition, manufacturers agreed they opened the eyes of the public, raising both curiosity and awareness of the world of fiberglass.

"When they put the pool in, they show it coming in — and BANG — here's the pool," says Prystupa. "They did kind of set that little mind-set that, 'Wow, that's kind of cool. They did that pool the week they did that whole house.'

"That element of surprise drives consumers to take action. When curious individuals see a pool floating in the air and being installed within a week's time on their TVs, they flock to the Internet to find out the back story. It's not to say consumers are smarter than they were years ago so much as to say that consumers just know how to find the information they need more quickly and have the tools to go about doing so, too.

Rise Of Technology

"I think one of the biggest catalysts for growth that we've had in our industry has been the Internet,because people can surf and see,"adds Prystupa. "There's thousands of Web sites out there for pools and all related equipment, as there is for most anything you buy today." And because of that, sales strategies in the fiberglass industry have changed.

"There's a big difference between offering a fiberglass shell to someone now and a fiberglass shell 10 years ago," says Keith Van Tilburg of San Juan Pools. Tilburg says fiberglass sales have become simpler now that the Internet is commonplace in many homes.

The fiberglass pool industry has done a very good job of educating consumers about the benefits of fiberglass through the use of the Internet,says Ashley Gill, CEO of Leisure Pools. "I would think 50 or 60 percent of our business comes through the Internet. It's a very powerful force. People are jumping online," he says.

Today's homeowners are technologically aware, therefore more apt to spend time researching a potential purchase from the back end before even stepping foot in a showroom.

"When someone needs to something about something, where do they go now?" asks Tilburg. Gone are the days of the encyclopedia and Yellow Pages. Consumers first look to the Internet, says Tilburg, to see who's out there and what they offer. "Then they start looking at the ones that they like and start researching further."

"There is no overestimating the effect the Internet has on sales," says Frank Kearney, co-owner of Able Installations in Wilmington, N.C. "What I think the Internet has done s the consumer can sit down at home, at their convenience, just surf, ask questions and see what pops up. That's why we see more and more, in my opinion, people who come in and say, 'I want a fiberglass pool.' They understand what's true and what's not true because they've already asked the question."

While tech-savvy consumers are vital to the growth of the fiberglass industry, industry professionals must also embrace the role they play in any current and future growth.

Down To Business

"We all pretty much say the same thing about our product, and we all report the same statistics and we all report the same benefits," says Stewart. "When a customer has decided that they really think fiberglass is right, and they start looking for a pool contractor, you may be the very best vinyl-liner installer in the country, but if you can't give them — or won't give them — what they want, you will not get their business. And ultimately, as business people, it's our job to give the customer what they want, not what we think they should have."

When Kearney established Able Installations with his wife in 1995, it had a few fiberglass models, but they weren't given much thought. "It was sort of the, 'Oh yeah, we've got those,too,'" says Kearney.

But then buying trends began to change. "I saw this trend developing. We find, and continue to find, that many people will say, 'No, no, all we want is fiberglass,'" says Kearney.

So he started educating himself. "I read trade magazines cover to cover. I read everything," he says. Then the time came when Kearney knew he needed to make a decision that would change the course of his business.

In late 2000, Kearney completely stopped production of other pool sand made the leap to exclusively build and sell fiberglass pools. "We made a decision a long time ago that we were going to build a quality product. And that's been a very good decision for us," adds Kearney.

Able Installations wasn't the only one to notice the rising popularity of the fiberglass pool. Mark Laven, president of Latham International, spent two years researching trends within the fiberglass industry. "Fiberglass is not anew segment of the industry. It's just a segment that's growing at a faster ratethan the base business today," he says. For that predominant reason, Latham International, one of the largest vinyl liner manufacturers in the country,acquired Viking Pools in 2004.

"This represented an opportunity for us to diversify our product line. And also to add geographic diversification, because vinyl-liner pools aren't sold in great number in some of the markets like California, Texas and Florida, where fiberglass pools are becoming increasingly popular," says Laven. "So that represented an opportunity for us to have a presence in those growth markets where there's just very favorable demographics."

Viking's decision to sell to Latham allowed it the latitude of affordable expansion into markets where it was previously unrepresented.

"I can't speak for Mark, but we did it so we can continue to grow," says Todd Stahl, president of the fiberglass division for Viking Pools. "And with the resources of Latham and with the innovation of what we're doing, it seemed like an ideal marriage" — one that aided in opening Viking plants in Florida and North Carolina, bringing its presence to five locations throughout the United States.

World View

Like Viking, other fiberglass pool manufacturers continue to expand their operations to include different regions across the country just to keep up with the growing demand for these pools. This rising popularity of fiberglass pools in the United States has piqued the interest of foreign manufacturers who see the potential to increase market share here even more.

Consider Leisure Pools. According to Gill, the Australian manufacturer nearly exhausted its room for growth back home. By 2000, nearly 25,000 pools were being installed yearly in Australia, and Leisure's own fiberglass market had matured. By the time Leisure decided to expand overseas, adds Gill, fiberglass in Australia held more than 50 percent market share, whereas the United States continues to hover around the 20 percent mark.

"So we started to look abroad, and we came over to the United States and carried out some market research," says Gill. "And we were quite shocked at what we found." While colored fiberglass had taken off in Australia, it hadn't yet been fully embraced by the U.S. market.

"So we saw the opportunity to bring our technology and our build quality and our color into the U.S. market. We knew that fiberglass here was going to become the fastest-growing segment of the market. And we wanted to be a part of that. We think the U.S. pool market will emulate what happened in Australia over the last 15 to 20 years, where fiberglass pools become very, very popular and the pool of choice."

"I think a lot of people are starting to recognize a good thing when they see it," says Danton Townsend, owner of Royal Pools and Patio in O'Fallon, Ill., which serves as Leisure's Midwest distribution point.

A Time To Change

More and more gunite and vinyl-liner builders are asking questions and even entertaining the idea of taking on fiberglass in some capacity, adds Townsend.

"We've got some of the largest concrete pool builders in the United States talking to us at the moment," says Gill. "These are guys doing 500-plus pools a year saying, 'We can't ignore it anymore. Consumers are wanting and asking us for fiberglass pools so we're going to add it to our lines.'"Even though some have embraced the effect fiberglass has had on the industry, there are still those who remain reluctant, but only due to their lack of knowledge regarding the recent changes in the fiberglass market, manufacturers claim.

"For the contractor who hasn't looked into fiberglass in the last five years, so much has changed," Stewart says. "And if your customers know the information and you don't, you will lose credibility. One of the things we're really trying to do with our dealer base is to pull them out of their comfort zone. It's very easy to stay with what you know, but the trend is changing. And the customer is changing."

Changing being the operative word. Change is inevitable no matter what side of the business you are on. Butthat evolving nature has driven the fiberglass industry from the edge of the unfamiliar to a product in constant demand.

The Fiberglass Update: Changes Mean More Appeal

"Back when I started in the mid-'80s, a typical family-size pool package was in the mid- to upper-teens," says Curt Prystupa, president of Sun Fiberglass Products. "Today, our average package is about $38,000." While economics plays a pivotal role in the cost increase, manufacturers also credit better building technologies that produce better products.

"We've gotten some science behind us now that we didn't have back in the early days," adds Prystupa. "We were using boat materials. We still use a derivative of boat materials, but we do have our formulations now for our pool interiors, and we do have our formulations for what we call our barrier coats, our skin coats.

"We've also stepped up and improved the quality of the raw materials. We've improved the lamination process. The manufacturers of the raw materials are now giving us like-finishes and lay-up products that are more geared toward building a pools shell."

Not only are the pools built with better quality, they are also available with more design possibilities. "I'll begin to talk about options, and man, that's when [customers] light up," says Frank Kearney, co-owner of Able Installations, Wilmington, N.C.

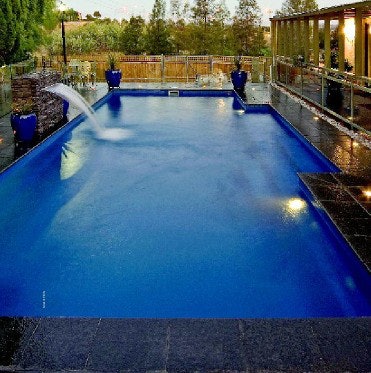

Fiberglass customers can now chose from such additions as vanishing edges, raised bond beams, water features, spill-over spas, salt-water chlorinators, and built-in steps, swim ledges,and seating areas, not to mention slip-resistant surfaces on the stairs and floors.

"We've tried to fit our product offerings to what the marketplace is looking for and tried to get more gunite-looking in some of the things that are out there," says Prystupa.

— J.E.