Here's some good news: The hot tub industry has finally regained some of its swagger.

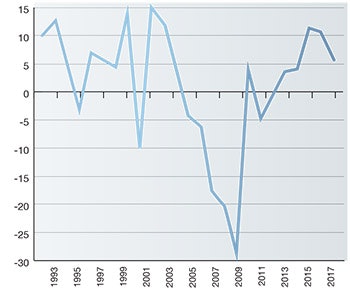

Until recently, things hadn't been particularly great for the hot tub business, especially during the recession. That's when the industry averaged a dismal -15.4 percent annual growth. Total spa shipments during that period dropped 58 percent. Not pretty.

The so-called recovery wasn't any great shakes, either. During the period 2010-2014, the industry managed a less-than-inspiring 1.1 percent average annual growth.

Over the past three years, things have begun to brighten a bit. Spa shipments hit double-digit growth in 2015-2016 and then cooled a bit last year.

Chart 1: Percentage change in new hot tub shipments, 1993-2017. Click to enlarge

Chart 1: Percentage change in new hot tub shipments, 1993-2017. Click to enlarge

Average growth over the past three years has been a rather respectable 9.3 percent, the highest three-year average since the last great pre-recession year of 2004, right before the fall. Before that, you would have to go all the way back to the late 1980s. Not too shabby.

So there is hope. But can this be sustained? To answer that, we need to have a better idea of the potential market for future hot tub sales.

Let's start with some basic numbers. There are currently about 70 million single-family households in the United States. Of those, about 40 million earn at least $50,000/year, according to census data for 2016. (Note that we focus on single-family homes because people living in apartments or condominiums are not very likely to own their own hot tub. And we set $50,000 annual income as a threshold based on Pkdata studies concerning the demographics of current hot tub owners.)

Related: Hot Tub Report 2018: Sales Still Hot

From that 40 million, you must further subtract the 6 million households who already own a hot tub. As much as we like the concept of a separate spa and separate toothbrush for every family member, the spa part probably isn't going to ever catch on.

Okay, that leaves 34 million. Where do we go from here?

This is where the new research comes in. Obviously not all 34 million families want a hot tub in their homes. (As much as we would wish otherwise.) One of the questions we frequently ask non-owners of hot tubs is, "Suppose you were buying a home from a previous owner and you notice there is a hot tub in the backyard. How would you react?" Almost invariably, 20-25 percent say they would not consider the spa to be a plus and would ask the owner to remove it as a condition of the sale.

To put a finer point on this, our newest research asks, "On a scale of 1 to 5, where a '5' indicates 'very likely,' how likely are you to consider the purchase of a new hot tub in the next five years?" The responses are depicted in Chart 2.

Chart 2: What spa non-owners say is the likelihood of purchasing a hot tub within the next five years. Click to enlarge

Chart 2: What spa non-owners say is the likelihood of purchasing a hot tub within the next five years. Click to enlarge

A generally recognized research standard says we should apply an appropriate probability discount to allow for the well-known phenomenon called "Champagne taste on a beer budget." For a big-ticket discretionary purchase like a hot tub, that works out to 50 percent of the "very likely" response base and 15 percent of the "generally likely" camp. So, here's the math:

That's a lot, but don't forget that's spread out over five years, so we ultimately end up with just over 494,000 customers a year.

So just how realistic is 494,000 hot tub customers in a year? Consider this: In the 25-year runup to the inimical downturn in 2005, the spa industry had a nearly uninterrupted climb, culminating in the sale of 417,000 hot tubs in 2004. How much further it might have reached without the intervention of the mortgage bust is hard to predict. But it only took four years to increase 100,000 units/year from 1999-2003. There is no telling where the business might otherwise have been today. So, the prospect of 494,000 sales is not out of the question.

Related: Stars are Aligned for the Pool and Spa Industry

Chart 3: Percentage of spa non-owners who have previously owned a hot tub. Click to enlarge

Chart 3: Percentage of spa non-owners who have previously owned a hot tub. Click to enlarge

But here's the problem: Even though sales the past three years have been more buoyant than usual, they have still only averaged about 225,000 units — way below the 2004 peak and even further from 494,000. That begs the question, how does the industry claw its way back?

Our latest research offers further guidance. For example, we thought it was interesting that 7.5 percent of non-owners said they had previously owned a hot tub.

Chart 4: Percentage of non-owners who have experienced a hot tub in the past 12 months. Click to enlarge

Chart 4: Percentage of non-owners who have experienced a hot tub in the past 12 months. Click to enlarge

If you go back to our estimate of 34 million qualified non-owners, that works out to 2.6 million former owners. That's almost half of the total current installed base. The good news is that they have already owned a hot tub, so they don't need to be educated about spa ownership virtues. The other good news is that former owners tended to score highest in terms of the previously discussed disposition to purchase in the next five years. That makes them an excellent prospect group.

Chart 5: Prior usage occasions by non-owners of hot tubs in the past 12 months. Standardized for multiple responses. Click to enlarge

Chart 5: Prior usage occasions by non-owners of hot tubs in the past 12 months. Standardized for multiple responses. Click to enlarge

Here is another related bit of encouraging data: Nearly 40 percent of non-owners say they have experienced a hot tub in the past 12 months. And of that group, nearly half cited hotels as the venue. (See Chart 5.)

So once again we discover that the spa experience is not new to non-owners. Yet if so many people have previously owned a hot tub or at least experienced a spa in the past year, why don't more people buy them? It is certainly not for lack of awareness. Perhaps this next piece of research offers a clue.

Chart 6: Numbers of acquaintances that non-owners say have spas of their own. Click to enlarge

Chart 6: Numbers of acquaintances that non-owners say have spas of their own. Click to enlarge

This presents something of a glass half full/half empty conundrum. This is saying that over half of non- owners have a friend, relative or other associate with a hot tub. On one hand, this perhaps explains why so many non-owners have experienced a hot tub, and it removes lack of awareness as a reason for disinterest. On the other hand, it can be argued that if you have friends with spas, why bother getting one of your own? (Of course, if the one or two people you know with hot tubs live far away, that's not a very good substitute.)

There could be one other reason, namely lack of "retail familiarity."

Chart 7: Percentage of spa non-owners able to recall one or more hot tub retailers. Click to enlarge

Chart 7: Percentage of spa non-owners able to recall one or more hot tub retailers. Click to enlarge

Related: In the Hot Seat: 4 Top Spa Dealers Discuss the Hot Tub Industry

In one of our final survey questions, we asked non-owners to recall any stores that sell hot tubs. Nearly three-quarters could not. (See Chart 7.) And nearly a quarter of the rest identified store brands that have never carried hot tubs.

This is a big problem. Every time someone shops at a home center, for example, they are almost sure to see major appliances. The same is true for backyard products at large discount chains. So where are the hot tubs? Pkdata's thesis all along has been that shoppers don't "occasion" hot tubs like they do washers and dryers, barbecue grills and home entertainment systems. So it's never top of mind when people want to splurge on something really rewarding.

In summary, the good news is that there is a lot of room for growth in the spa business. Rather than seeing 2004's 417,000 sales mark as a fluke, everyone should instead think of the ensuing downturn as only a temporary detour to even higher attainment.

But this research also shows that there is work to be done. There are a lot of folks out there who already know the virtues of the spa lifestyle, but they're not knocking on the door. Maybe moving the door a little closer to them will open the way to 400,000 sales — and beyond.

Up can be pretty high.

Bil Kennedy is president of Pkdata, an Atlanta research and consulting firm that has tracked the swimming pool and hot tub industry since 1992. The firm provides market guidance to leading pool and spa products manufacturers, retailers and builders in the U.S. and globally.