The past few years have seen a steady revival in the pool and spa industry. After a recession shuttered many businesses and left others bruised, the economy gradually recovered. Slowly, pool and spa pros were dusting themselves off and getting stronger once again.

Consumers are in a better position this year, which Charles Schwab credits to smaller debts and hourly earnings that rose by a modest but welcome 2.5 percent in 2015. In addition, fuel costs swiftly fell, further lining consumers' pockets with extra dollars.

All signs point to a strong 2016, but — there's always a "but" — for pool and spa pros, not everything is rosy.

Despite some improvement in the economy, retailers continue to lose significant sales to online companies like Amazon, where their customers look to compare prices — a phenomenon called showrooming. Many retailers find their doors open less often as customers skip the store altogether, instead opting to order their pool and spa products from online retailers.

The rise of online sales remains a striking concern for the pool and spa industry. According to the results of our Retail State of the Industry survey, it's the No. 1 source of anxiety.

To help, manufacturers are releasing products intended for sale by brick-and-mortar dealers only — including automatic pool cleaners, pumps and chemicals — as a way to driving more foot traffic to stores. Sixty-three percent of the retailers who took our SOI survey carry these products, and of that number, 76 percent say these products help them compete.

"We desperately need these types of products to differentiate ourselves from online retailers," one retailer wrote.

Some retailers find the best way to compete is to change from within. With outdoor living becoming a strong force in the home design sphere, pool and spa retailers are expanding their offerings to include outdoor living products such as pergolas, decks, outdoor furniture, pavers, grills, fire pits and more. Slightly more than half of our SOI respondents offer outdoor living products, a figure we expect will climb in the coming years.

Another common thread in this year's SOI results: the power of great support staff. When asked for the top reason customers enjoy their store, the No. 1 response was "knowledgeable staff." However, finding qualified employees is a challenge.

"Trying to find help that can meet our expectations is not easy. We expect our employees to treat every customer the way we do as owners," one respondent wrote.

For those with the same struggle, we asked retailers to share the best strategy to find new employees, summer help in particular. The vast majority, 42 percent, turn to their customers for job candidates. Next time you're looking for new employees, share it in your newsletter, on social media or even while chatting at the checkout counter. You never know who you'll find.

Retailers in this industry face many of the same battles as small businesses in other industries, from online sales to the more day-to-day management struggles. ("How am I going to stock this product, meet with my manufacturer rep, hang new signage and do my social media posts in one day?")

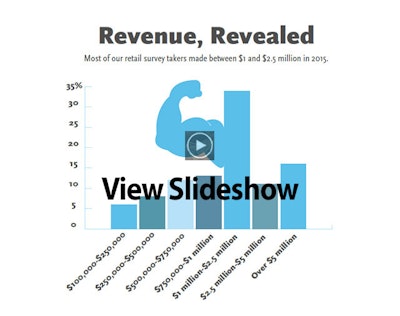

Yet unique to this industry is the determination to fight through problems and succeed — according to our survey, 64 percent of our respondents said their businesses are getting stronger.

"We're opening a second retail location, and our construction is growing steadily," one retailer wrote.

When asked about the future, 48 percent of respondents said they're worried about the future, but doing okay right now. But just behind that figure, 42 percent of our respondents are "very comfortable" with the future of the industry, and see a bright future.

While we're still in a time of cautious optimism, it's clear the industry leans more toward optimism than ever before.

Comments or thoughts on this article? Please e-mail [email protected].

Industry Spotlight: PentairWith online sales and competition from big box stores on the rise, retailers need to adapt to remain successful. Luckily, there are several ways of doing so. Pentair, long recognized as one of the best-run, most professional companies in pool and spa industry, shares some helpful ideas here on modern retailing. AQUA: How should dealers approach the issue of trade-only products when talking to customers? Kevin Braidic, Product Marketing Director, Pentair: Trade-only products are often eligible for extended warranties, special consumer rebates and seasonal promotions that are not available to e-commerce dealers. Most importantly, trade professionals provide unmatched technical expertise and familiarity with their customers' pools to help insure accurate equipment sizing, proper installation/set-up and one-on-one product training. Trade professionals invest heavily in training, which means they are most qualified to answer questions and resolve product issues. The pool professional is there to provide critical after-sales support, both in-store and on-site which releases the consumer from having to ship product directly back to the manufacturer. AQUA: What steps should brick-and-mortar retailers take this year to better position themselves against online vendors and big box stores? KB: Customer service! Recent trends reveal that the online shopping experience continues to surpass the in-store experience. This is not a product issue; it is an experience issue. People do business with those they know, like and trust. This is a huge advantage that B&M can enjoy over online competitors. That's why they must connect with customers, cultivate relationships and create experiences that keep customers coming back. AQUA: How do you see the role of the brick-and-mortar retailer changing in light of the increasing popularity of online retailers? KB: Retailers must embrace change. We have seen many brick-and-mortar retailers expand their business to installation and service in order to provide added value and needed services for their customer base. Pool equipment installation is complicated and not something with which most DIY'ers are comfortable. Although e-commerce purchases still account for a small percentage of sales, some dealers have chosen to treat Internet buyers as prospects for future business by installing and servicing their online purchases. They hope to cultivate them into full-service customers in the future, as their needs change and grow. AQUA: How can retailers help their customers see the light when it comes to energy-efficient products? KB: Utilize manufacturer-provided tools to calculate the lifetime value of sustained savings on their energy bills. As an added-benefit, explain that energy-efficient products often run longer, quieter and require less maintenance. Stay informed of current utility rebates in your area, as they provide added incentives for consumers to invest in energy-efficient products. |