Recently, we took a look at a graphic from P.K. Data that revealed where inground residential pools are most common across the U.S. This week, we delve into that a little further.

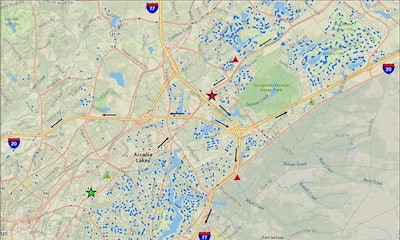

Take a look at the above map of a neighborhood in South Carolina. You’ll see two stars, a red one and a green one, each representing hypothetical pool and spa retail stores. The blue dots represent the locations of inground swimming pools, based on real estate records and other sources. (In other words, we're zooming in on last week's graphic to a local level.)

According to P.K. Data’s hypothetical, the green store began its operations at that location in the 1980s. At the time, its location on a major 4-lane highway was desirable, but things changed over time: neighborhoods in the northeast expanded and the Interstate throughway and connectors were completed, rerouting traffic from the Northeast into the city to the South. If you take a closer look at the black arrows, you’ll see traffic from the green store’s neighborhood is flowing North, away from the store.

Now, say the red store was built at the same time as the new neighborhoods and highway expansion. Judging by the black arrows, that location is able to take advantage of better proximity to traffic movement.

You can also see where each store has placed their billboards by looking at the red and green triangles. Based on the traffic patterns, which store has the greatest visibility to prospective customers? How did the owner of the red store know where to open his store and place his billboards?

The lesson of this story: Every pool and spa retailer should take advantage of traffic counts, which are published by local and state traffic departments. (They’re public domain and usually free.)

In addition to examining the traffic flow of your area, it’s imperative for store managers to understand his or her effective trading area for their store. Ask yourself who, and where, your competitors are located — and don’t limit yourself to direct competition from fellow pool and spa dealers; also consider big box stores, too.

Finally, how many pool and/or hot tub owners are within five or ten miles of each of your stores? That alone might explain why one store is lagging or exceeding.

According to P.K. Data: “We are continually impressed by the limited number of retailers who can truly articulate their trading area. The typical answer is usually along the lines of 'Probably a 10-mile radius…' But if so, how do you know? And if it is 10 miles, how many pool and hot tub households are contained in the radius? What’s your share? Who is the competition? How do they deploy? And so on.”

P.K. Data also argues that this is an issue that extends beyond pool and spa dealers — it’s a matter people should consider industry-wide.

“The emergence of ecommerce notwithstanding, retailers are this industry’s 'boots on the ground.' Given the absence of a cohesive and collective mass media strategy to elevate the awareness and desire for swimming pools and hot tubs, at the very least everyone on both ends of the supply channel should be supporting the retail establishment with the very best in local intelligence. The technology is certainly here.”

![IPSSA’s incoming President Michael Denham [left], Rose Smoot, IPSSA Executive Director [center] and the outgoing President, Todd Starner [right].](https://img.aquamagazine.com/files/base/abmedia/all/image/2024/04/New_IncomingPres_MikeDenham_RoseSmoot_outgoing_president_ToddStarner_IMG_3920_copy.662682e0cbd3a.png?auto=format%2Ccompress&fit=crop&h=167&q=70&rect=0%2C345%2C3024%2C1701&w=250)

![IPSSA’s incoming President Michael Denham [left], Rose Smoot, IPSSA Executive Director [center] and the outgoing President, Todd Starner [right].](https://img.aquamagazine.com/files/base/abmedia/all/image/2024/04/New_IncomingPres_MikeDenham_RoseSmoot_outgoing_president_ToddStarner_IMG_3920_copy.662682e0cbd3a.png?auto=format%2Ccompress&fit=crop&h=112&q=70&rect=0%2C345%2C3024%2C1701&w=112)